Every other week we've been asking a selection of our contributors for their opinion regarding what we believe are some of the most pressing market-focused questions of the week. This week we wondered: As trade tensions mount, with little to no end in sight, what will be your strategy for FX and equities moving forward?

- Dollar should confirm a bottom in the next few months while the euro tops out

- Big-time asset-deflation with equities, junk bonds, and housing taking a huge hit; gold, long-dated Treasuries, and cash will be the winners

- Higher commodity prices and stronger growth have remained supportive of NZD; narrowing interest rate differentials, the threat of tariffs could threaten its strength

Tom Luongo

First off, I see Trump's push for steel and aluminum tariffs as a negotiating ploy to bring Mexico and Canada to the table about NAFTA.

This was a key plank of Trump's campaign platform, and like his moving the U.S. Embassy to Jerusalem, he's making a bold opening move to remove certain issues from the negotiations. So, a renegotiated NAFTA will likely end any tariffs quickly. But for now, this has the markets spooked, playing into Trump's desire for a weaker dollar for as long as possible. He's a mercantilist, after all.

Technically, the Dow and the NASDAQ look strong, while the euro looks toppy. Three month pound and US dollar LIBOR rates are rising, indicating a growing lack of US dollar liquidity. This is supported by The Fed's balance sheet data which is seeing massive parking of U.S. Treasuries by foreign central banks on reserve with the Fed. Emerging market central banks now have more than $3.1 trillion in USTs on reserve with the Fed, reversing the draw-down that occurred during the 'Taper Tantrum." $87 billion in 2018 alone, a huge move.

All of this is setting up for more choppiness in FX markets as a reflection of the political situation in Europe and Trump's power plays with his staff within the White House, c.f. Cohn leaving, rumors of a National Security Council shake-up. But, Trump can't keep the dollar down for much longer. Tariffs will accelerate dollar liquidity concerns. Tariffs lower money velocity. The ECB has no exit strategy for QE with Italy's election results. Draghi's 'hawkish tone' was wishful thinking.

The vulnerable asset class is still European sovereign debt. The USD should confirm a bottom in the next few months while the euro tops out, though it could put in a spike top on Italian debt fears before rolling over. Stocks will be the main beneficiary as investors continue to flee into 'hard' assets. Note how gold couldn't rally to new highs in the face of a very weak dollar, so on the first impulse up in the dollar gold will likely sell off on liquidity concerns but also confirm the 2015 low as the cycle low.

So, for now, current trends are in place while markets are confused and choppy. But, I'm looking for an exit point in the long EUR/USD trade, a bottom in the USD and a confirmatory spike low in gold. Emerging markets heavily exposed to the dollar are very vulnerable here. The Turkish lira is especially vulnerable as is the Canadian dollar.

Mike Shedlock

It is extremely foolish to think steel tariffs will increase employment or reduce the deficit. But here we go anyway.

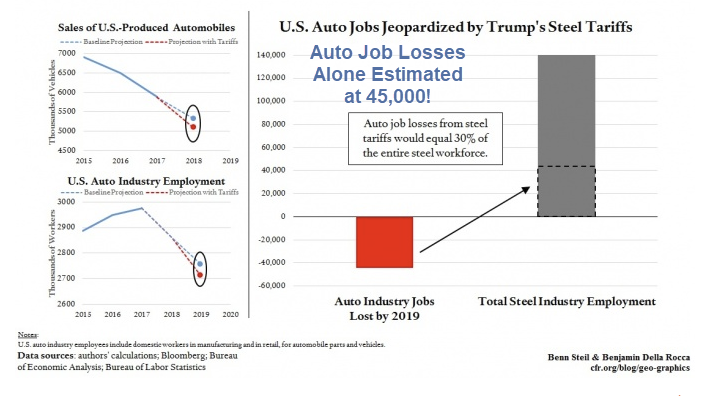

President Trump says "Trade Wars are Good and Easy to Win" but he is mistaken. No one wins trade wars. There are about 6.5 million workers at manufacturers that use a lot of steel, but only 140,000 steelworkers, says Moody’s. The auto industry alone faces steep job losses.

Even without that bit of math, it's economic madness to protest getting something too cheaply! Trade tensions are just one piece of the puzzle when it comes to equities and forex. Stocks are tremendously overvalued. In Sucker Traps and the Arithmetic of RiskI noted that some expect equities to decline as much as 67% from here.

I think we are right about here.

(Even if stocks decline only 20% over the course of the next five years, pension plans need six to seven percent returns each year. Effectively plans in Illinois, California, Kentucky and numerous other states will be wiped out.)

Housing is weakening, autos are weakening, and GDP estimates are falling.

No comments:

Write comments