TOKYO/SYDNEY (Reuters) - Asian stocks bounced from near two-week lows on Tuesday as investors paused for breath following the heavy selling of recent sessions and waited to see if the dollar's rally was sustainable.

MSCI's broadest index of Asia-Pacific shares outside Japan (MIAPJ0000PUS) was 0.2 percent higher, having hit its lowest level since April 9 following two straight days of declines. Japan's Nikkei (N225) rose 0.7 percent, helped by a decline yen which supports exporting firms.

Chinese shares climbed about 2 percent (CSI300) (SSEC), while Hong Kong's Hang Seng index (HSI) added 1 percent.

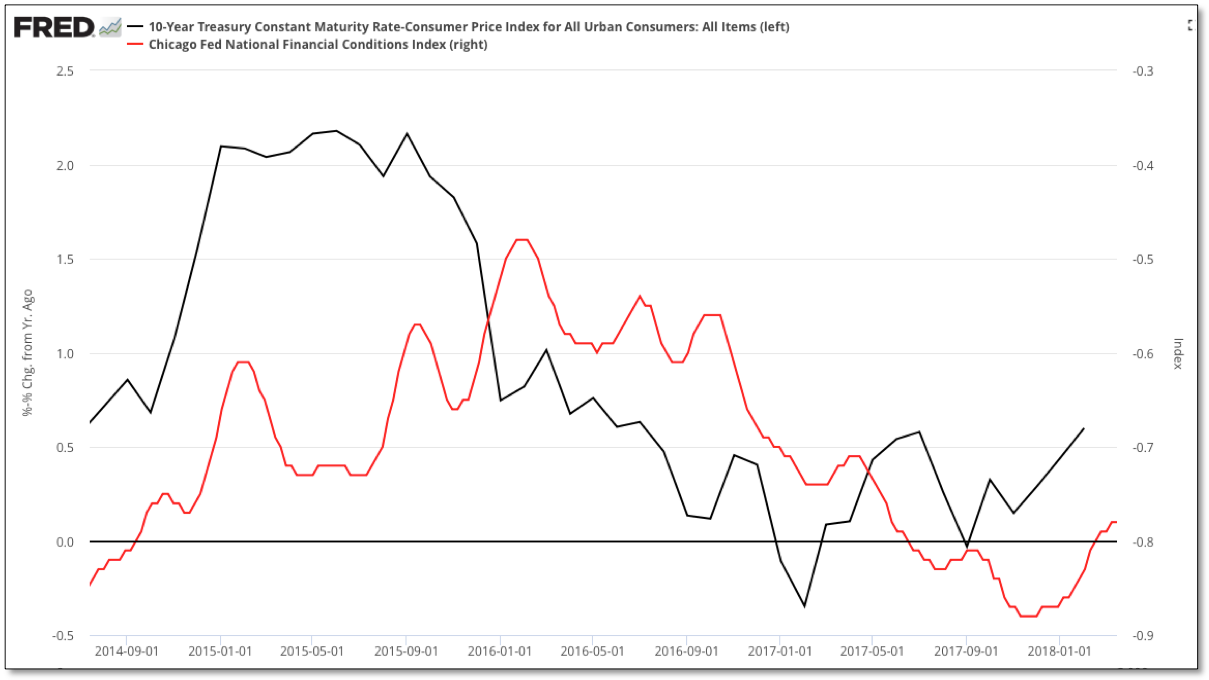

U.S. bond prices rebounded too, capping four days of falls that sent 10-year Treasury yields closer to the key psychological barrier of 3 percent - a level not seen since early 2014. (US10YT=RR)

The U.S. dollar, which has risen in the past five sessions against a basket of major currencies, also took a breather to camp near a four-month peak. (DXY)

"Investors are now watching closely to see if we are in the eye of the recent storm of volatility or if we do have calm seas ahead leading to stronger global growth," said Nick Twidale, Sydney-based chief operating officer at Rakuten Securities Australia.

"Only time will tell but certainly the market is keeping a close eye on the news wires and screens for anything that may lead to a return to volatility and downside risk."

The bond market is bracing for combined sales of $96 billion in coupon-bearing Treasuries this week on greater government borrowing following a massive tax overhaul last year and a two-year budget agreement reached in February.

Inflation worries are also mounting as oil and commodity prices have been rising in recent weeks.

Market gauge of investors' inflation expectations such as the 5-year forward inflation swap and 10-year breakeven yield have hit their highest levels in many months.

Investors are thus concerned U.S. inflation, long subdued since the financial crisis a decade ago, could gain momentum as President Donald Trump's tax cuts this year could stimulate an economy already near or at full employment.

That could prompt the U.S. Federal Reserve to raise rates more than three times this year, practically ending a decade-long liquidity party.

U.S. stocks were little changed on Monday as bond yield worries offset optimism on corporate earnings.

Analysts expect earnings growth at S&P 500 companies of nearly 20 percent in the first quarter, the strongest showing in seven years, according to Thomson Reuters data.

Of around 18 percent of the companies in the S&P 500 that have already reported, 78.2 percent beat consensus estimates.

METALS AND CURRENCIES

In currencies, the dollar was a shade firmer at 108.75 yen after jumping almost 1 percent on Monday to its highest in ten weeks.

The greenback also strengthened against emerging market currencies, hitting three-month highs against the South African rand and a 1-1/2-year top against the Brazilian real .

The euro held at $1.2210 (EUR=) after hitting its lowest since March 1 when Trump unveiled tariffs on imported steel and aluminium.

In commodities, aluminium extended losses after plunging 7 percent on Monday, its biggest one-day drop in eight years.

Three-month aluminium on the London Metal Exchange last stood at $2,272 per tonne after the United States extended the deadline for sanctions on Russian aluminium producer Rusal (HK:0486).

The metal had rallied to its highest since mid-2011 last week at $2,718 a tonne on fears of a global shortage as a result of the U.S. sanctions.

Oil prices held near 3-1/2-year peaks supported by production cuts by oil producing countries and wariness about geopolitical risks in the face of Washington's threat to scupper a nuclear deal with Iran.

Analysts see further gains in oil.

"Despite the rise in oil prices in recent weeks, the U.S. rig counts have not increased that much," said Tatsufumi Okoshi, senior commodity economist at Nomura Securities.

"Recent data shows oil inventories have been falling so I expect oil prices to rise further unless we see a sharp increase in U.S. oil drilling rigs."

U.S. West Texas Intermediate crude futures (CLc1) rose 30 cents to $68.95 per barrel, not far from last week's high of $69.56 while Brent crude futures (LCOc1) added 24 cents to $74.95 after having hit 3-1/2-year highs of $75.20.